Free Self Employed Tax Software

If you are self employed own a home or have investments you wont pay extra to file guaranteed. Includes itemized deductions and hundreds more.

What S The Best Tax Software For The Self Employed Here S

What S The Best Tax Software For The Self Employed Here S

free self employed tax software is a free HD wallpaper sourced from all website in the world. Download this image for free in HD resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark free self employed tax software using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Federal 0 state 1499.

Free self employed tax software. We provide digital tax solution to make it easier for our users to file their tax returns. It has not been previewed commissioned or otherwise endorsed by any of our network partners. The content of this article is based on the authors opinions and recommendations alone.

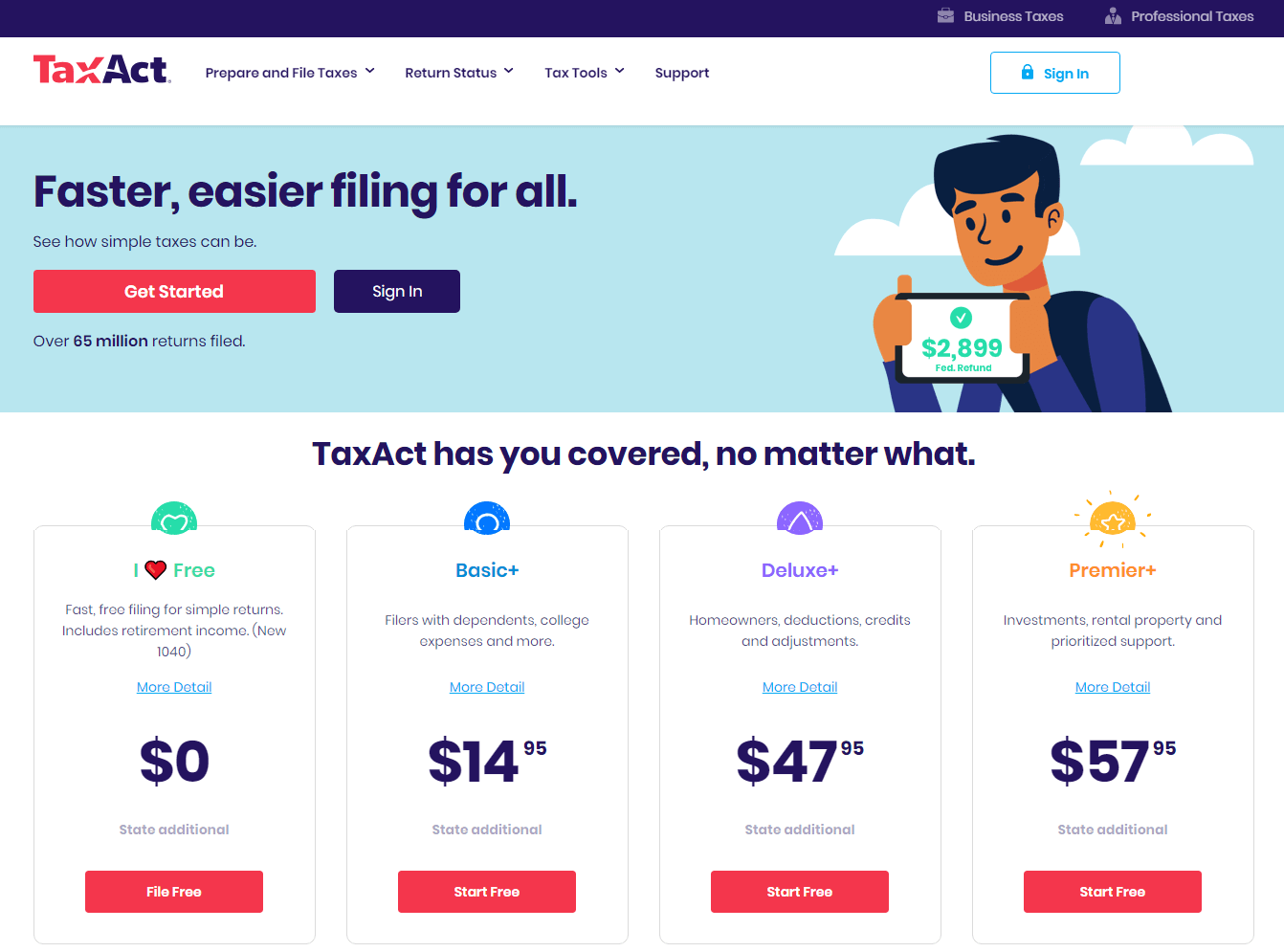

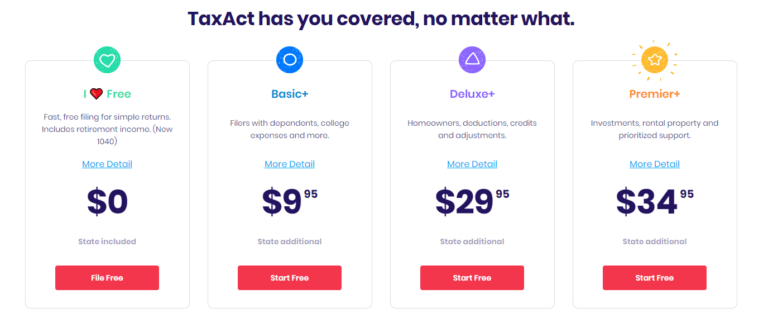

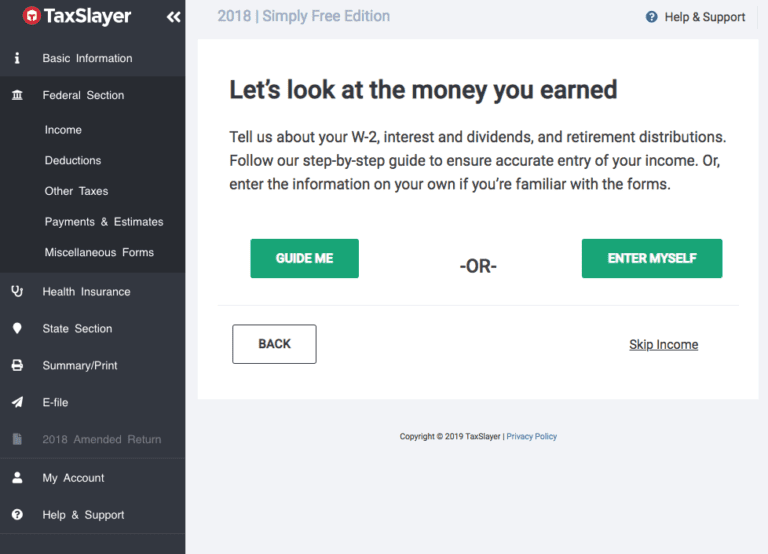

Then choose the right 2019 tax preparation software even if you go with the best free tax software for self employed. Taxact personal tax software for business owners comes in two varieties. Compare tax filing software whats included in our free service.

When it comes to small business tax preparation youll need to do more than file 1040 forms. Self employed online software and self employed desktop software. To know more tricks on how you might have better refunds and tax savings for 2019 online tax returns then visit our taxes usa category and learn more tips.

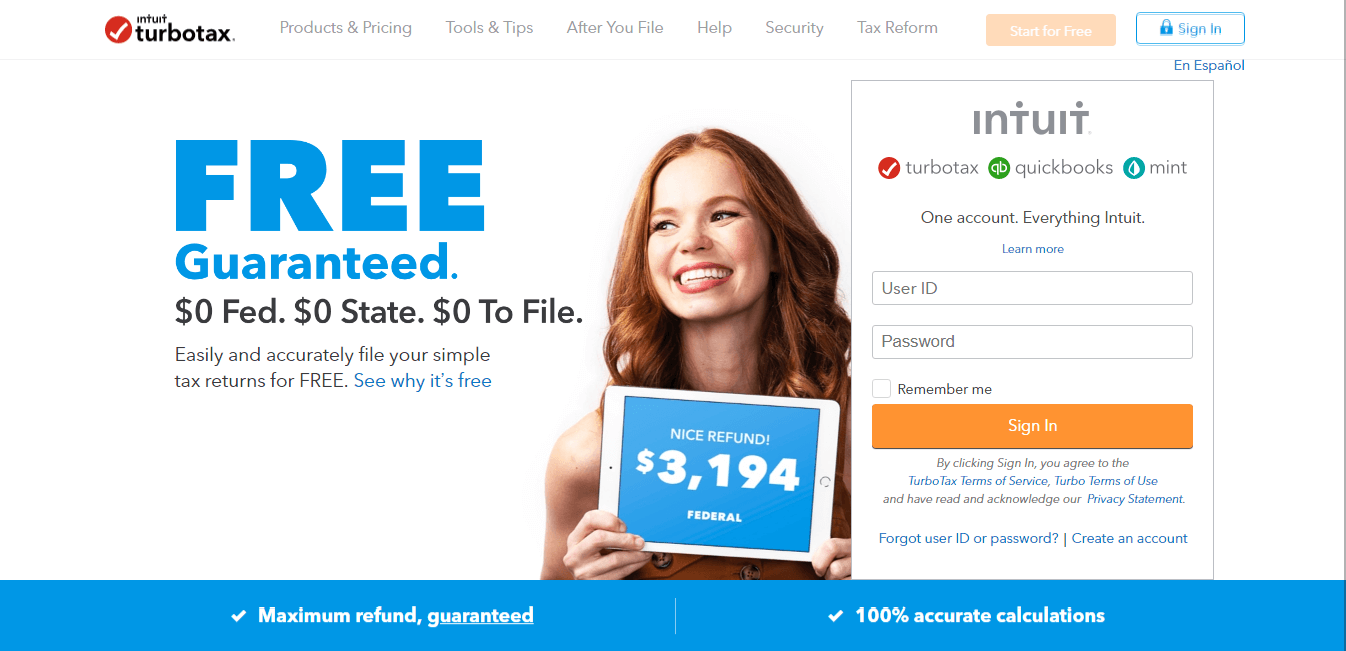

Turbotax self employed online tax software allows you to prepare both self employed income taxes and small business taxes. See all supported forms. Taxact self employed is an online tax software that is ideal for freelancers.

Self employed tax filing always free no hidden fees. Self employment earnings may be one of the more common reasons tax preparation gets complex since there is only the self employed taxpayers receipts and annual information may be built from scratch at tax time. Maximize your tax deductions if you work as a contractor freelancer online seller ride share driver small business owner and more.

It costs 4995 and you can file both federal and state tax returns for your business and your. 7 best online tax software for the self employed. Our premium tax software was designed to help selfemployed filers make smart and tactical tax decisions.

However because self employment income is so common it is covered in a t1 federal tax return which canada revenue agency approved. Some cloud based accounting software even makes it easy for you to share records with an accountant and all choices come with a free trial so you dont invest in the software unless youre sure youll be able to use it. Basetax has been helping sole traders self employed and individuals with their accounting and tax since 2014.

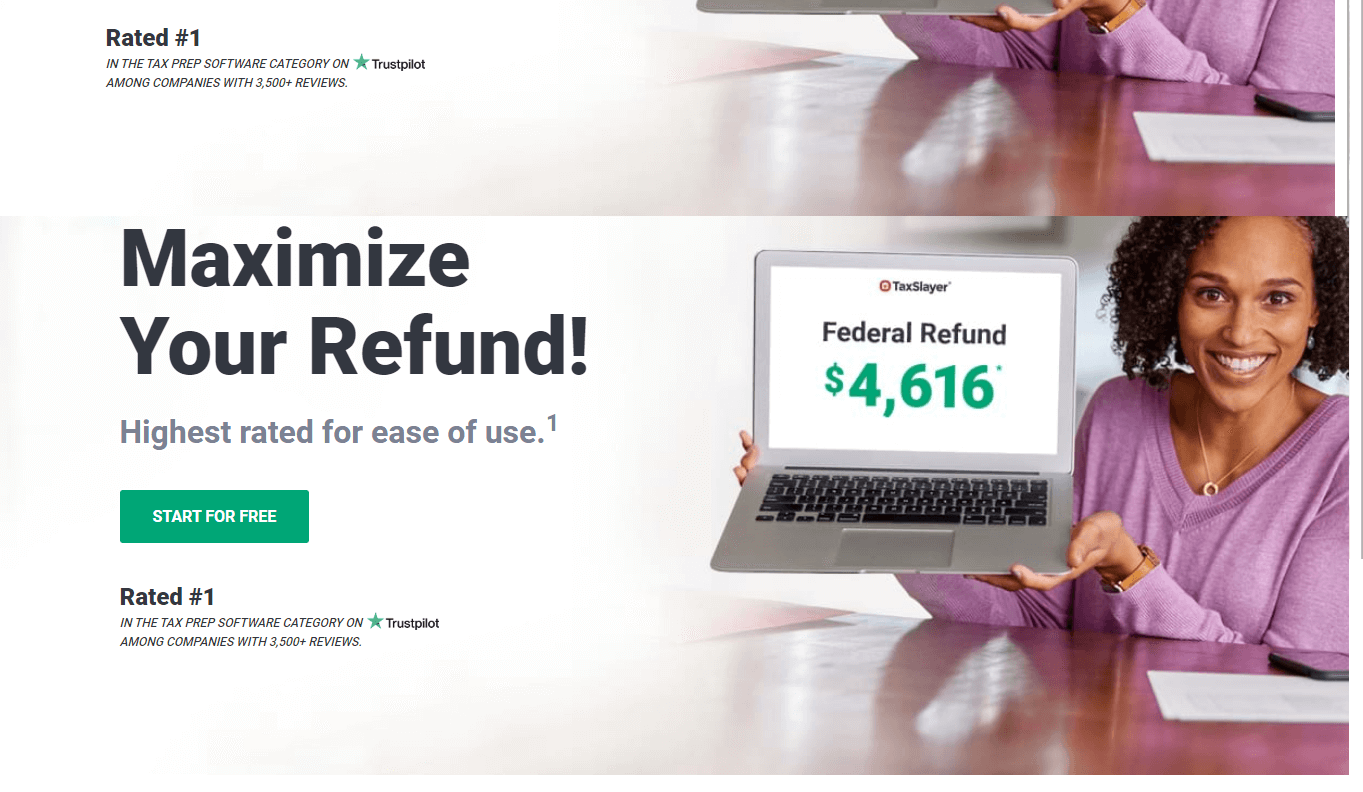

Benzinga explores the best tax software to use if youre self employed including free and low cost options. This software is easy to use has help documentation written in plain english and does the double entry accounting for you.

What S The Best Tax Software For The Self Employed Here S

What S The Best Tax Software For The Self Employed Here S

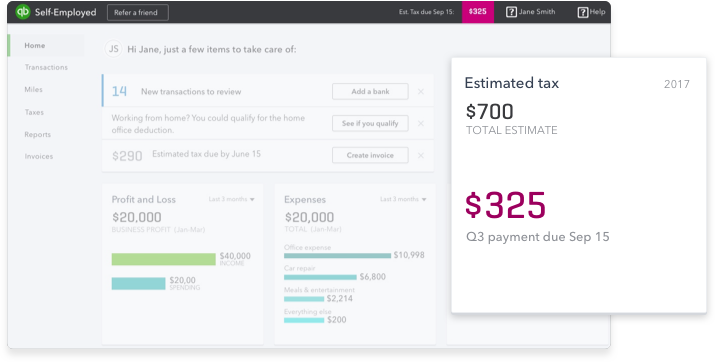

Self Employment Tax Software Quickbooks Self Employed

Self Employment Tax Software Quickbooks Self Employed

What S The Best Tax Software For The Self Employed Here S

What S The Best Tax Software For The Self Employed Here S

The Best Online Tax Software For 2019 Reviews Com

The Best Online Tax Software For 2019 Reviews Com

What S The Best Tax Software For The Self Employed Here S

What S The Best Tax Software For The Self Employed Here S

Self Employment Tax Software Quickbooks Self Employed

Self Employment Tax Software Quickbooks Self Employed

Self Assessment Tax Return Software Gosimpletax

Self Assessment Tax Return Software Gosimpletax

The Best Tax Software For 2019 Reviews By Wirecutter

The Best Tax Software For 2019 Reviews By Wirecutter

What S The Best Tax Software For The Self Employed Here S

What S The Best Tax Software For The Self Employed Here S

Credit Karma Tax Reviews Pros And Cons Who Is It Good For

Credit Karma Tax Reviews Pros And Cons Who Is It Good For

The Best Online Tax Software For 2019 Reviews Com

The Best Online Tax Software For 2019 Reviews Com

0 Response to "Free Self Employed Tax Software"

Post a Comment