Depreciation On Computer Software

You can take a 50 special depreciation allowance for qualified reuse and recycling property. Qualified reuse and recycling property is any machinery or equipment not including buildings or real estate along with any appurtenance that is used exclusively to collect distribute or recycle qualified reuse and recyclable materials as defined.

Computer Software Depreciation Calculation

depreciation on computer software is a free HD wallpaper sourced from all website in the world. Download this image for free in HD resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark depreciation on computer software using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

The accountants matching principle requires that the cost be allocated over the useful life.

Depreciation on computer software. An accountant might use a useful life of five years for her new computer since the accounting software does not change significantly.

Computer Software Depreciation Calculation

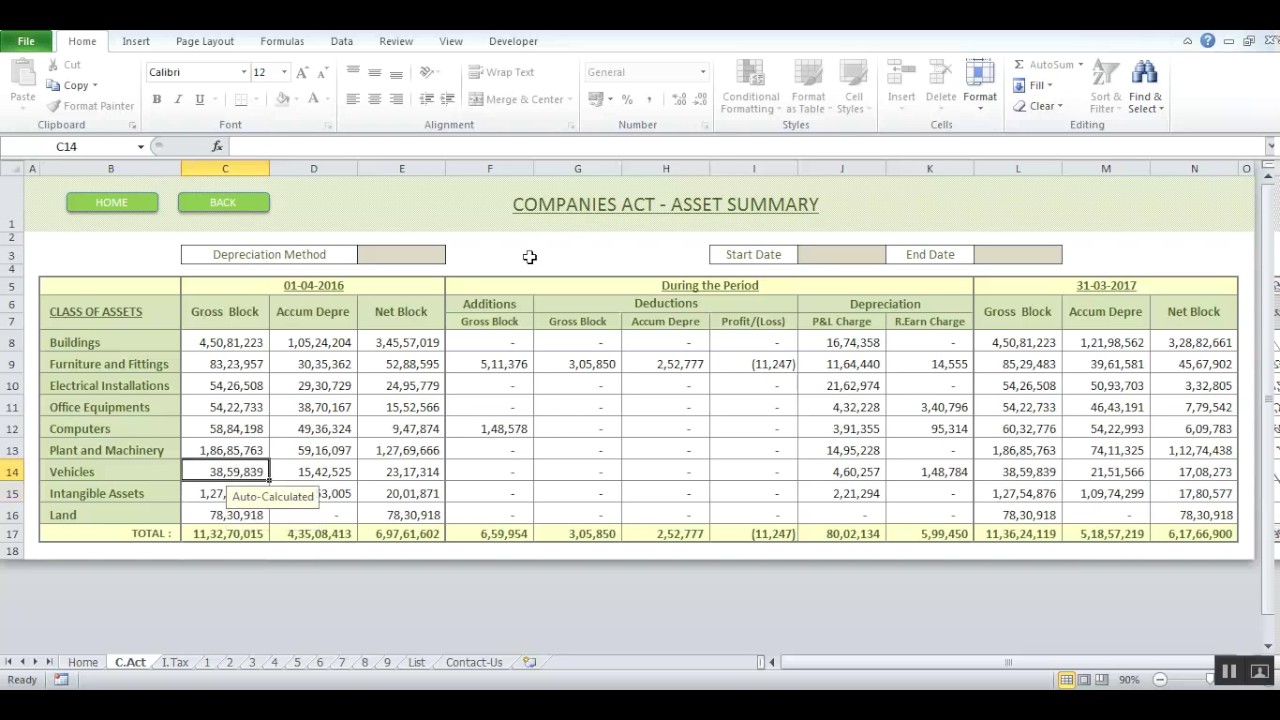

New Depreciation Rates Fy 2016 17 And 2017 18 Accounting

New Depreciation Rates Fy 2016 17 And 2017 18 Accounting

Computer Software Depreciation Calculation

Depreciation Cum Fixed Asset Software

Depreciation Cum Fixed Asset Software

Depreciation On Fixed Assets Or Capital Goods Pass Entry In Tally Erp 9 6 1 Gst

Depreciation On Fixed Assets Or Capital Goods Pass Entry In Tally Erp 9 6 1 Gst

Depreciation Calculation In Busy Hindi

Depreciation Calculation In Busy Hindi

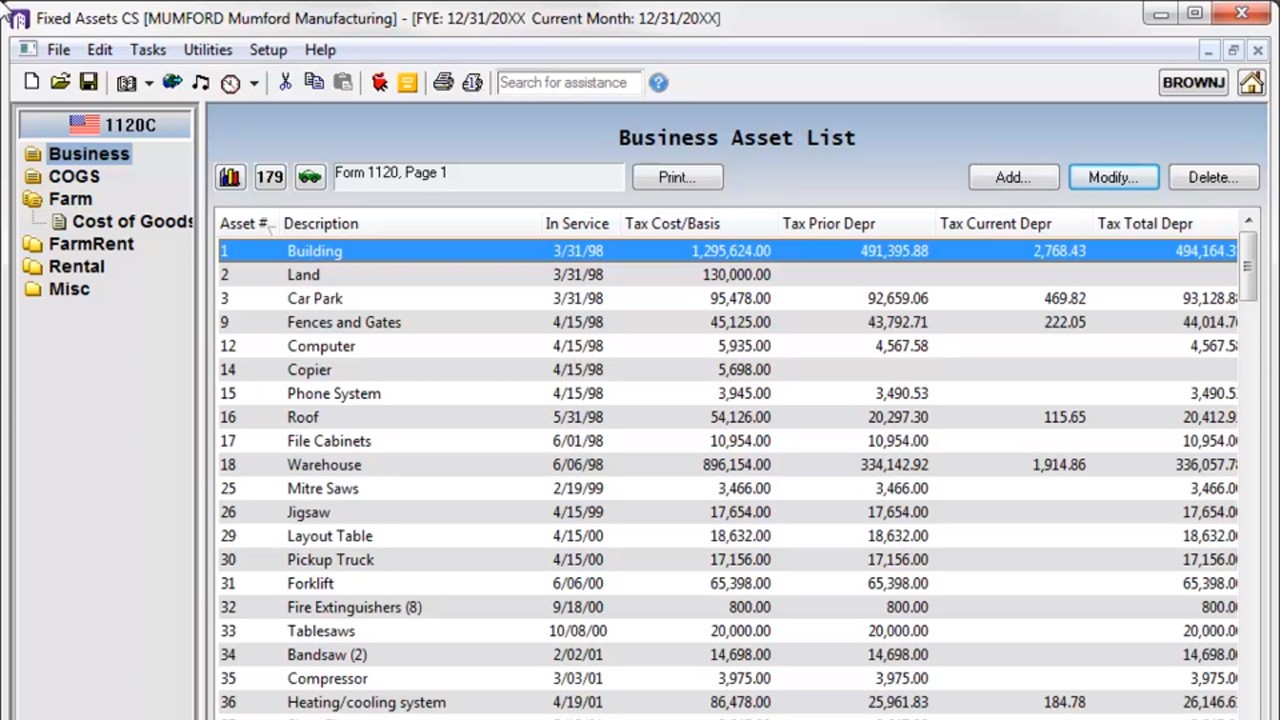

Fixed Assets Cs Chapter 1 Introduction Reporting

Fixed Assets Cs Chapter 1 Introduction Reporting

Erp Shop Management And Accounting Software Henning

Erp Shop Management And Accounting Software Henning

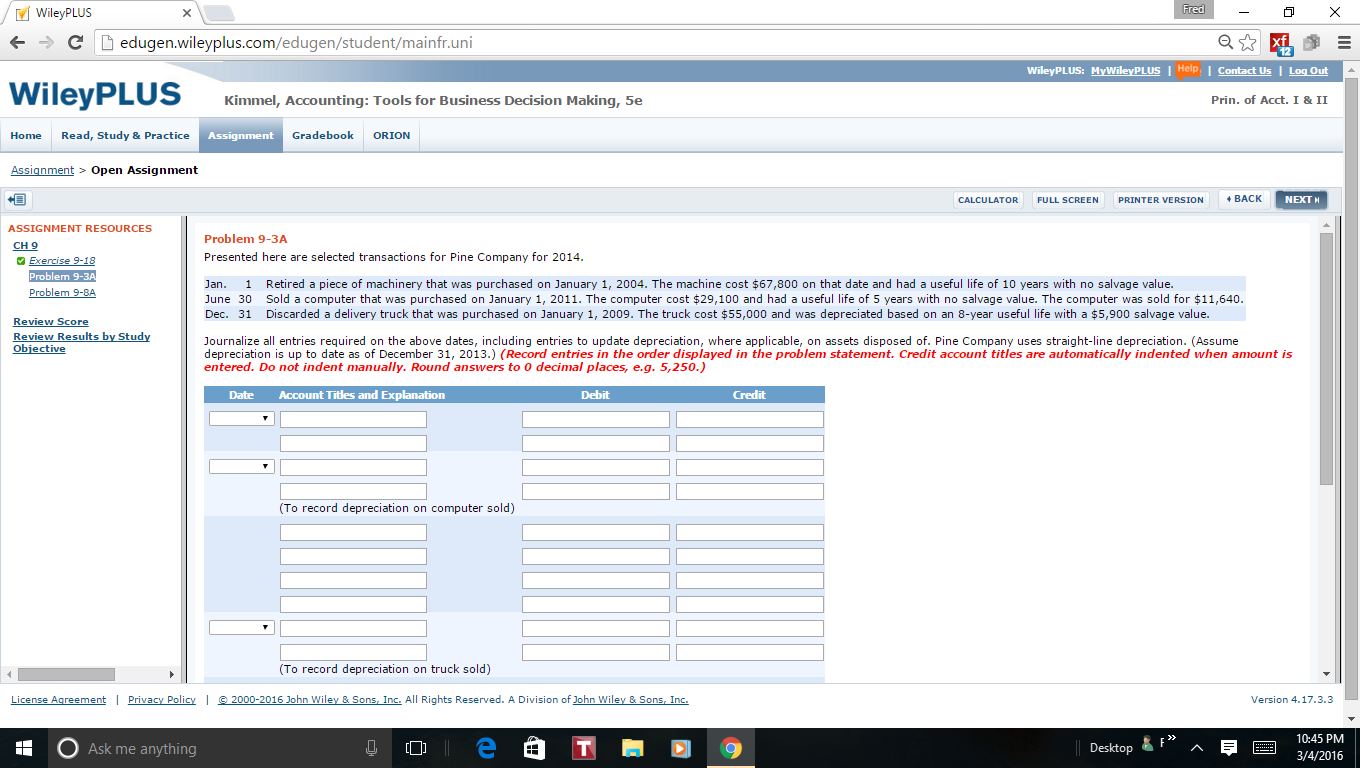

Solved The Word Problem Is On Slide 1 And The Whole Chart

Solved The Word Problem Is On Slide 1 And The Whole Chart

![]() Depreciation Rate For Furniture Plant Machinery

Depreciation Rate For Furniture Plant Machinery

How To Calculate And Post Fixed Asset Depreciation In

How To Calculate And Post Fixed Asset Depreciation In